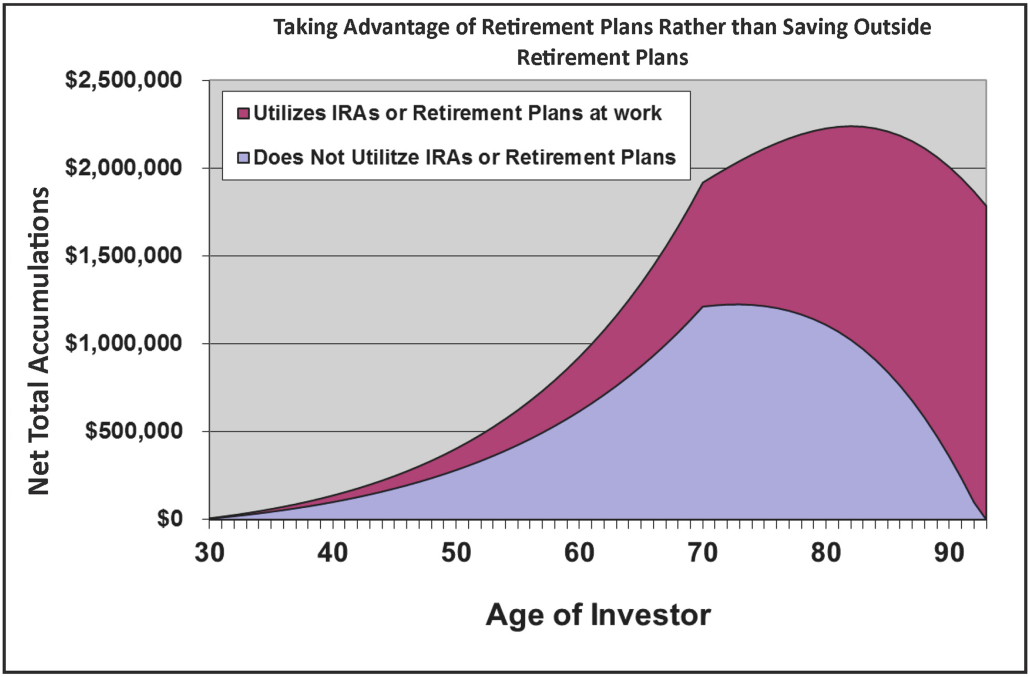

While you are still working, you shouldn’t pass up the opportunity to contribute the maximum allowable to your retirement plans. Same-sex marriage may afford you additional possibilities to contribute that may not be available to you as an unmarried individual; on the other hand, marriage might also eliminate possibilities to contribute.

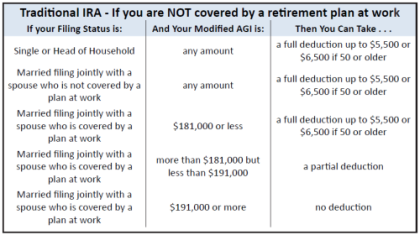

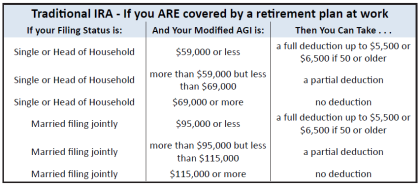

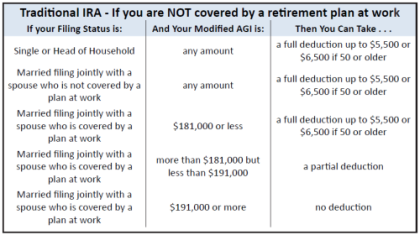

One advantage of marriage comes into play if one member of the couple is not working. This is relevant because you must have earned income to contribute to any IRA, including a Roth IRA. If a couple is not married, and one partner is not working, that non-working partner will not be allowed to contribute to an IRA or a Roth IRA. However, if the couple marries, the nonworking spouse would be able to contribute to an IRA or Roth IRA based upon their working spouse’s income. Marriage makes it possible for the couple to put more money in the tax-deferred or tax-free environment. For example, consider the couple Anne and Susan. In 2014, Anne earns $150,000 per year and is not covered by a retirement plan at work. Susan is not working outside the home. If they are unmarried, Anne can contribute to an IRA, but Susan has no earned income and cannot. If they marry, then both Anne and Susan can each contribute $5,500 ($6,500 if they are age 50 or older) to their respective IRAs.

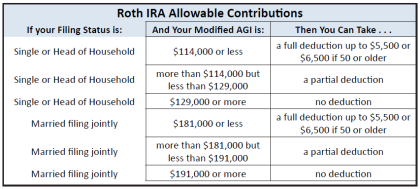

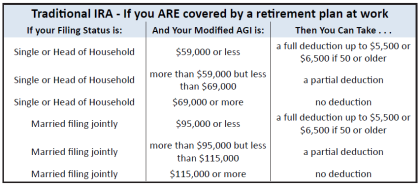

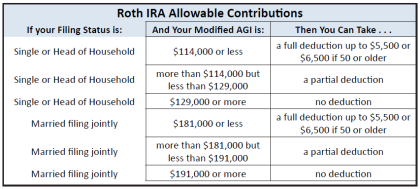

When it comes to Roth IRAs, there is a potential benefit if your income is too high for you to be eligible to make a full Roth IRA contribution. These income limits are different for married and unmarried individuals (refer to table below). You may find that your income is too high for you to make a Roth IRA contribution as an unmarried taxpayer, but you are able to make a contribution as a married taxpayer. For example, consider Anne and Susan again. In 2014, if they are unmarried, neither Anne nor Susan can contribute to their Roth IRAs. Anne earns above the maximum of $129,000 for a single taxpayer and Susan has no earned income. If Anne and Susan marry, then their combined income of $150,000 is under the $181,000 limit for married couples, so they are both permitted to make the maximum allowable contributions to their Roth IRAs.

In other cases, marriage may suddenly make you ineligible to contribute to a Roth IRA. You may find that both you and your partner, as an unmarried couple, are both near the upper income limit for single taxpayers and are able to contribute to Roth IRAs; however, if you were to marry and combine your salaries, you may find yourselves above the Roth IRA limits. Consider a different situation for Anne and Susan. In this case, Anne and Susan each earn $100,000 in 2014. As an unmarried couple, they are each eligible to contribute fully to a Roth IRA, because they are each below the $114,000 limit. If they marry, their combined income would be $200,000, putting them above the $191,000 phase-out limit and preventing both of them from making any Roth IRA contributions at all.

Finally, if your income exceeds the limitations for a Roth IRA, consider contributing to a nondeductible IRA. You can convert the nondeductible IRA to a Roth IRA the minute after you make the nondeductible IRA contribution. That is exactly what I do personally, in addition to my 401(k) contribution. So, in January, 2014 I made my 2013 and 2014 nondeductible IRA contributions for me and my wife Cindy (even though she doesn’t work outside the home). We immediately made Roth IRA conversions of the nondeductible IRAs. So, we put away a quick $26,000 tax-free into Roth IRAs ($6,500 each for 2013 and 2014), not including what I contributed to my 401(k). Please note this conversion of nondeductible IRA to a Roth without incurring taxable income only works if you don’t have any traditional IRAs. In effect, after the monkey business, it is just like making a Roth IRA contribution, but you have to do the monkey business first to get around the limitation.

Because retirement plans allow your money to grow tax-deferred or tax-free, and we have already seen the enormous power of retirement plans, you may want to consider the impact that marriage will have on your ability to contribute to an IRA or a Roth IRA.

Retire Secure! For Same-Sex Couples – James Lange, (pages 61-65) www.outestateplanning.com/contact-us 412-521-2732