LGBT Couples Need New Financial Advice!

James Lange, CPA/Attorney, highlights potential financial benefits available to LGBT couples who marry

Pittsburgh – April 28, 2015 –The United States Supreme Court is hearing arguments today on the issue of marriage equality. This historic case should be decided by June.

The two likely possibilities of the decision are:

- Supreme Court says all states have to offer same-sex couples the right to marry.

- Supreme Court says all states have to recognize marriages performed outside their state.

In either case, all states will likely have to recognize same-sex marriage, even if the couple has to travel to get married in a state that does recognize same-sex couples and then return home.

WHAT ARE THE FINANCIAL BENEFITS OF MARRIAGE?

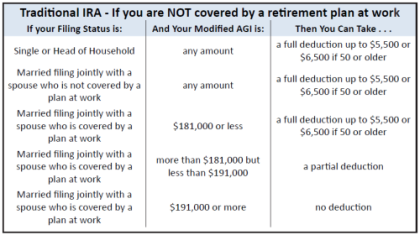

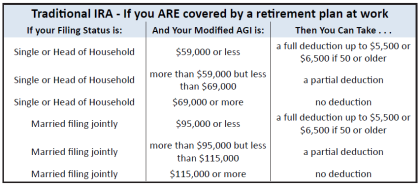

According to James Lange, a best-selling author, Certified Public Accountant, attorney and president of Pittsburgh-based Lange Financial Group, there are potential benefits that many people know about including the “marriage bonus” when preparing tax returns and health benefits being extended to new spouses. But what many people do not consider are 2 enormous financial benefits of marriage for couples who are 60 and over:

According to James Lange, a best-selling author, Certified Public Accountant, attorney and president of Pittsburgh-based Lange Financial Group, there are potential benefits that many people know about including the “marriage bonus” when preparing tax returns and health benefits being extended to new spouses. But what many people do not consider are 2 enormous financial benefits of marriage for couples who are 60 and over:

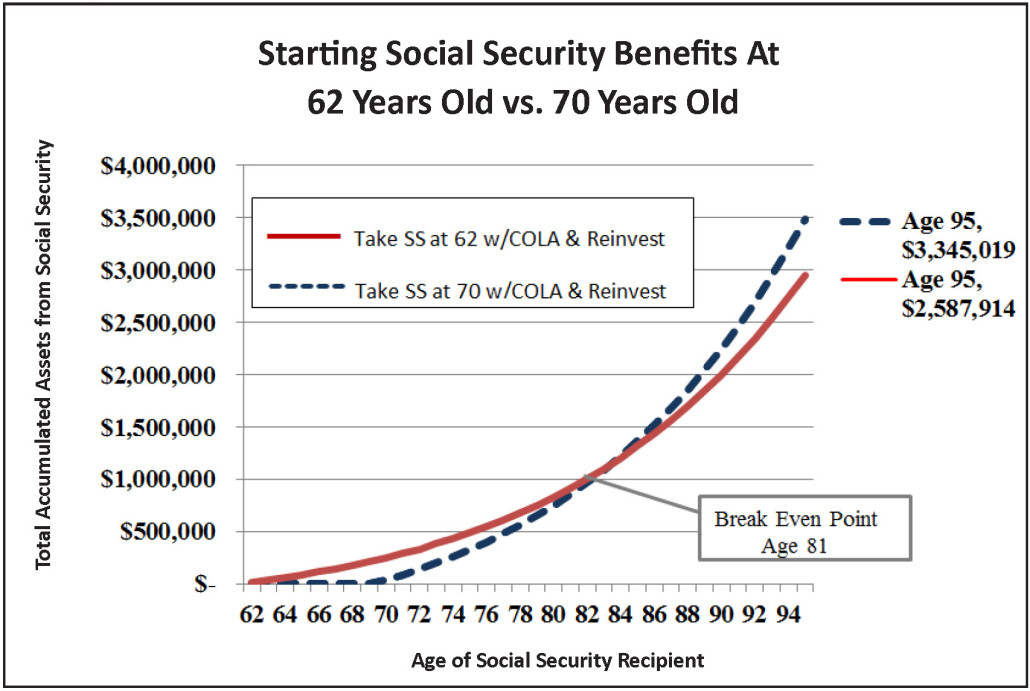

1. Marriage can increase your Social Security benefits: There are options to increase your total household Social Security benefits when you are married. Spousal benefit rules impact a couple while both are alive, and the survivor benefit available is impactful after one spouse passes. Over time, the difference can be hundreds of thousands of dollars or even millions of dollars. This could be even more important if one spouse has a strong earnings record and the other spouse does not.

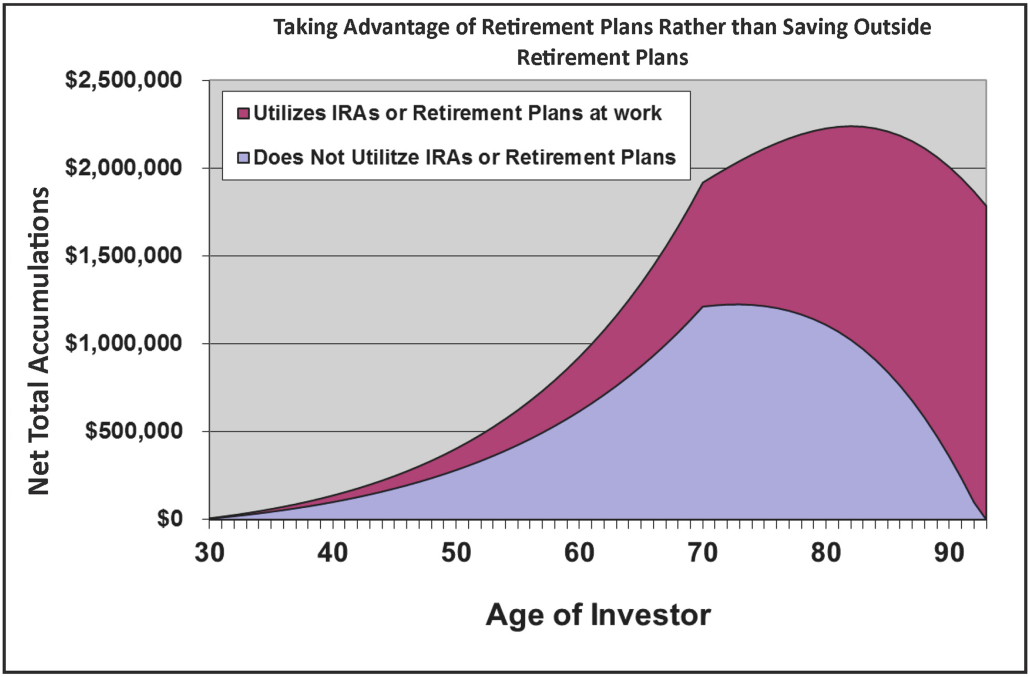

The graph below shows the difference between a couple not getting married and taking their Social Security benefits at age 62, versus getting married and utilizing a technique called Apply & Suspend for their Social Security. The difference is going broke in your 90s versus having more than $2 million.

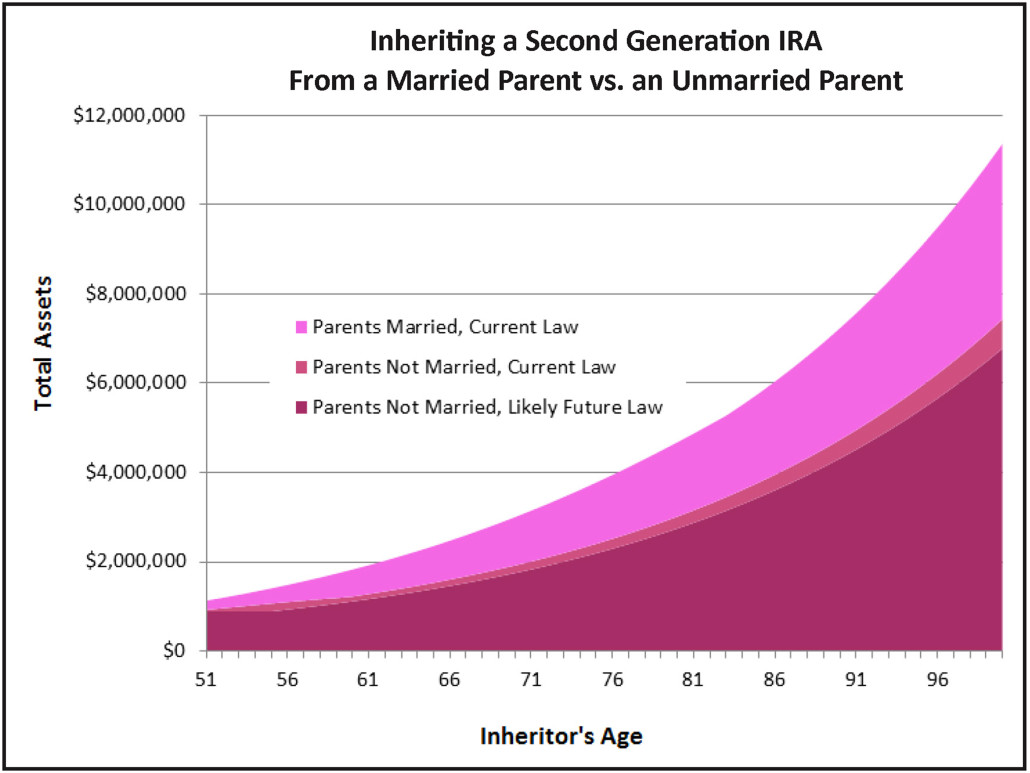

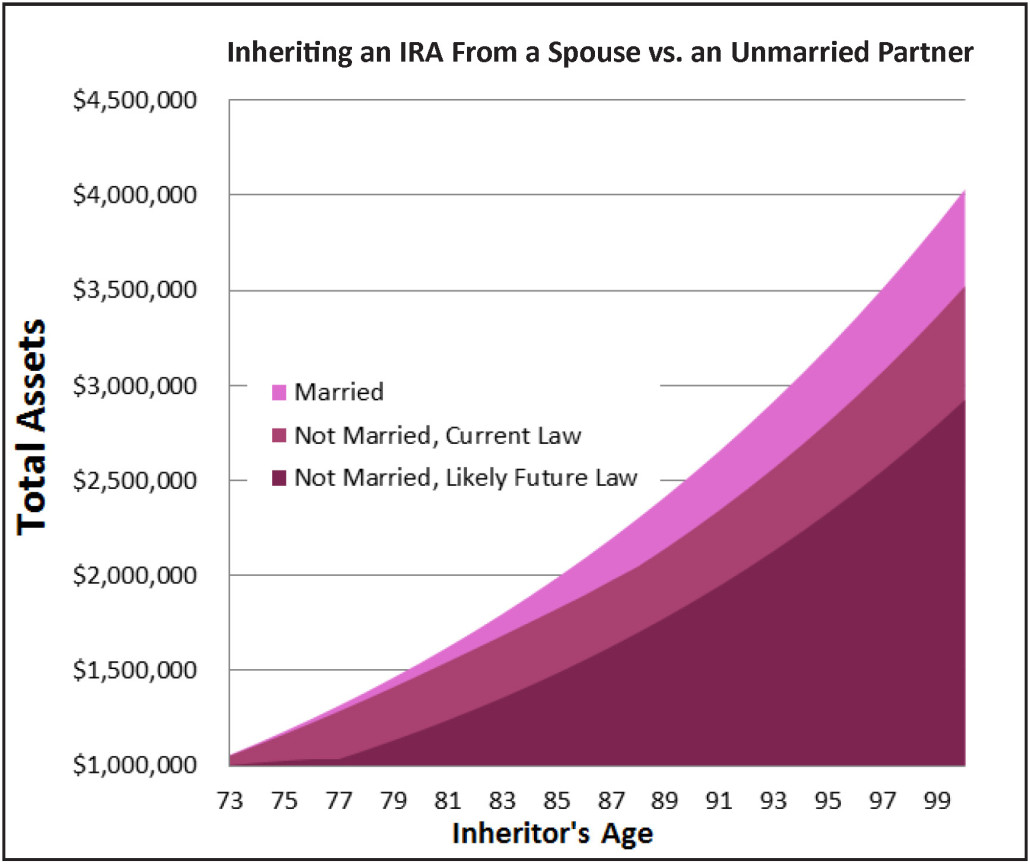

2. For purpose of inheriting money, most states and the federal government impose less inheritance and income taxes on assets left to a spouse than on assets left to a non-spouse. After Windsor (a previous case), however, the IRS will recognize same-sex marriages for federal income and estate tax purposes as long as the couple was married in a state that recognizes same-sex marriages. This makes transfer of assets between a married LGBT couple much easier than between a non-married couple.

Lange warns, however, that there could be some drawbacks including the potential health care liability of getting married, and the so called “marriage penalty” that may affect some taxpayers. He encourages same-sex couples that are currently marriage or weighing the benefits of marriage to read his book, Retire Secure for Same-Sex Couples: Live Gay, Retire Rich, in which he details recommendations for the issues mentioned herein and so many more.

Lange’s book lays recommendations in a convincingly detailed yet surprisingly easy-to-follow fashion and is available to purchase through www.outestateplanning.com.

About James Lange

James Lange, CPA/Attorney started the first exclusive LGBT estate planning website in Pittsburgh, in 2002. Jim is a nationally-known Roth IRA and retirement plan distribution expert. He’s also the best-selling author of the first and second edition of Retire Secure! and Retire Secure! for Same-Sex Couples. With over 30 years of experience, Jim and his team have drafted over 1,995 wills and trusts with a focus on flexibility and meeting the unique needs of each client.

James Lange, CPA/Attorney started the first exclusive LGBT estate planning website in Pittsburgh, in 2002. Jim is a nationally-known Roth IRA and retirement plan distribution expert. He’s also the best-selling author of the first and second edition of Retire Secure! and Retire Secure! for Same-Sex Couples. With over 30 years of experience, Jim and his team have drafted over 1,995 wills and trusts with a focus on flexibility and meeting the unique needs of each client.

Jim’s recommendations have appeared 35 times in The Wall Street Journal, as well as the Pittsburgh Post-Gazette, The New York Times, Newsweek, Money magazine, Smart Money and Reader’s Digest. His articles have appeared in Trusts and Estates magazine, The Journal of Retirement Planning, Financial Planning, The Tax Adviser (AICPA), and other top publications.

To learn more, or sign up for their newsletter, visit www.outestateplanning.com