I want to thank everyone for the overwhelming response to my new book, The Little Black Book of Social Security Secrets. We’ve received an unprecedented number of phone calls and emails from readers who have read it, and who now realize that the choices that they make about Social Security can have an enormous impact on their retirement years. Many of you want to know if you’re making the right decision about when to collect Social Security, and have written with the specifics of your situation. Unfortunately, I just cannot answer all of your questions personally. But what I will try to do on this blog is address some of the major issues that seem to be of the most concern to my readers. For same-sex readers who are legally married and who have filed for Social Security benefits, the burning question seems to be, “Are they ever going to process my claim?”

What is the status of the backlog of claims that have already been filed by same-sex couples?

Social Security recently released Emergency Message EM-16013 REV, which provides their employees with long-overdue guidance on how to process the existing claims of same-sex individuals who were trapped by conflicts created when they married in one state, but lived in another. This guidance effectively makes same-sex couples subject to the same deemed filing rule that is applied to opposite-sex couples. And, while the Emergency Message is a good start, I’m not convinced that we will see a resolution to the backlog any time soon. Many readers who are not even subject to the subtle interpretations of the Social Security rules that came as a result of The United States vs Windsor have told us about the backlog in processing their claims – so this is not necessarily a problem unique to same-sex couples. We’re hearing horror stories from many traditional married couples whose applications have been in limbo for over a year!

I will devote a future blog post to some ideas that might help you move your existing claim along a little more quickly. But for now, let’s look at some of the other questions raised by readers who are evaluating their options, but who have not yet filed.

When is the best time to apply for Social Security? Should I take my benefits now, or spend my retirement savings and apply later?

Several readers have written and said that they are in a situation similar to this one:

My employer has just told us that the company has filed for bankruptcy and will be closing its doors later this year. I don’t know if I will be able to get another job at my age and, even if I do, I’m not sure I will be able to make as much money as I am making now. My spouse doesn’t work outside of the house. I was thinking about signing up for my Social Security benefits once the company closes, but then I read your book. I do have some savings in retirement plans (both traditional and Roth), and an investment account. When is the best time for me to apply for Social Security if I can’t find another job? Should I spend my savings now and apply for Social Security later, or should I save my money and apply now?

The loss of a job, especially at this point in your life, can be traumatic. Before we review the options that you have, let’s go through a quick refresher on two of the points covered in The Little Black Book of Social Security Secrets.

When Should You Take Social Security?

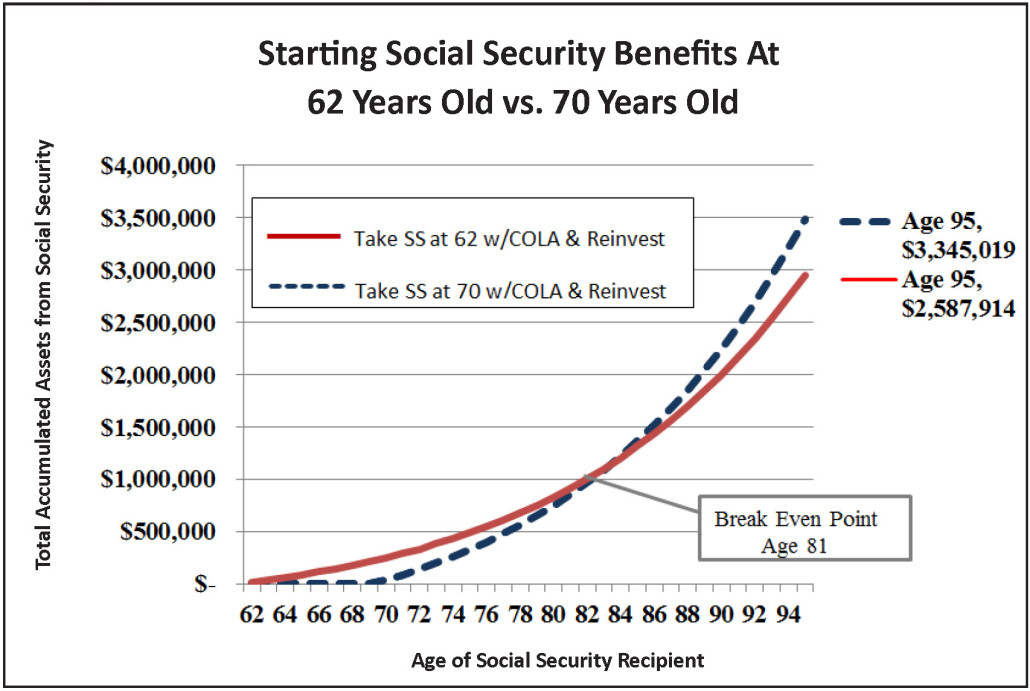

How does the age at which you actually collect Social Security affect the amount you receive? Legally married same-sex couples are now eligible to receive the same Social Security benefits as traditional married couples. If you are now 62, your Full Retirement Age (FRA) is 66. If you wait until your FRA to collect your benefits, you will receive your Primary Insurance Amount (PIA). If you collect at 62, your monthly check will be permanently reduced, by 25 percent of your PIA. If you wait until you are 70 to collect, your check amount will be permanently increased by Delayed Retirement Credits (DRCs) of 8 percent per year (up to a maximum of 32 percent), plus Cost of Living Adjustments (COLAs).

When Should Your Spouse Take Social Security?

This next part is critical to understanding why you may have more options than you realize. If you file for your own benefit (or, if you already filed for and then suspended your own benefit), your spouse will be permitted to file for spousal benefits based on your record as soon as he or she is eligible. When your spouse files, though, is as important as when you file. If your spouse waits until her FRA (for readers born between 1943 and 1954, this is 66), she’ll receive the highest spousal benefit possible – which is 50 percent of your own PIA. She is allowed to file as soon as she turns 62 but, if she does, she will only receive 35 percent of your PIA. In this example, we’re going to assume that your spouse is not entitled to a benefit based on her own earnings record. I have some examples for two-income households coming up in a later post.

The answer to the above question posed by my readers, therefore, will depend on how old both of you are. If you filed for and suspended your own benefit by the deadline of April 29, 2016, that will make it possible for your spouse, assuming that she is at least 66, to file for a spousal benefit that will be 50 percent of your own PIA. (She can file at 62, but her benefit will be reduced.) The spousal benefit will give your family some income from Social Security every month, while at the same time allowing your own benefit to grow by those DRCs and COLAs. Maybe you can’t get another job that pays as well as the one you have right now, but you might be able to get one that you enjoy a lot more – like working on a golf course – because your spouse now has a source of income that can make up the difference.

Remember that, in order for your spouse to be able to claim spousal benefits based on your record without you having to collect your benefit, you had to have filed for and suspended your own benefit by April 29, 2016. If you did, your spouse can collect spousal benefits while your own benefit continues to grow by DRCs and COLAs. If you didn’t file and suspend by April 29, 2016, your spouse cannot collect spousal benefits unless you are also collecting your own benefit.

So what happens when you do get that pink slip? As tempting as it might be to just throw in the towel and collect whatever Social Security you can, I’d recommend that you continue working in some capacity if you are able to do so. Even a part-time job will provide you with some money and, if your spouse is able to claim spousal benefits based on your record, you just might have enough income to meet your expenses while still allowing your own benefit to grow to the maximum possible.

Should I Spend My 401(k) Money First?

Many of my readers have some money in retirement plans (both traditional and Roth), and also some money in non-retirement accounts. They’ve asked me which account they should spend first, and whether it is better to take Social Security early so that they can delay spending their retirement accounts for as long as possible. So let’s look at the alternatives.

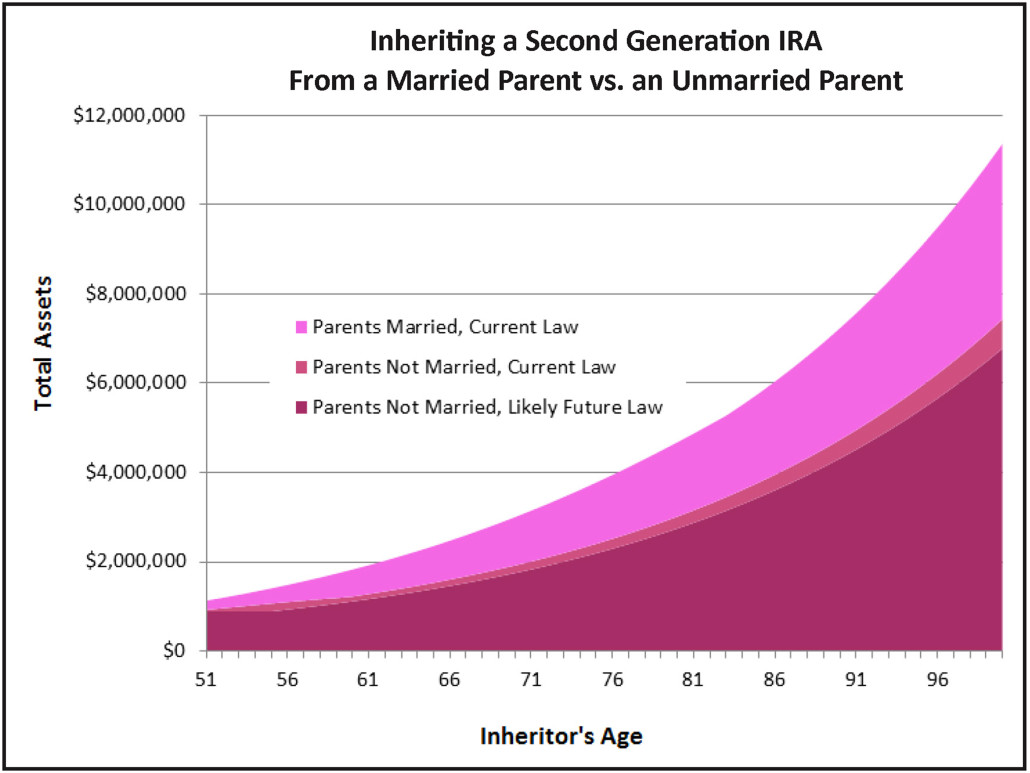

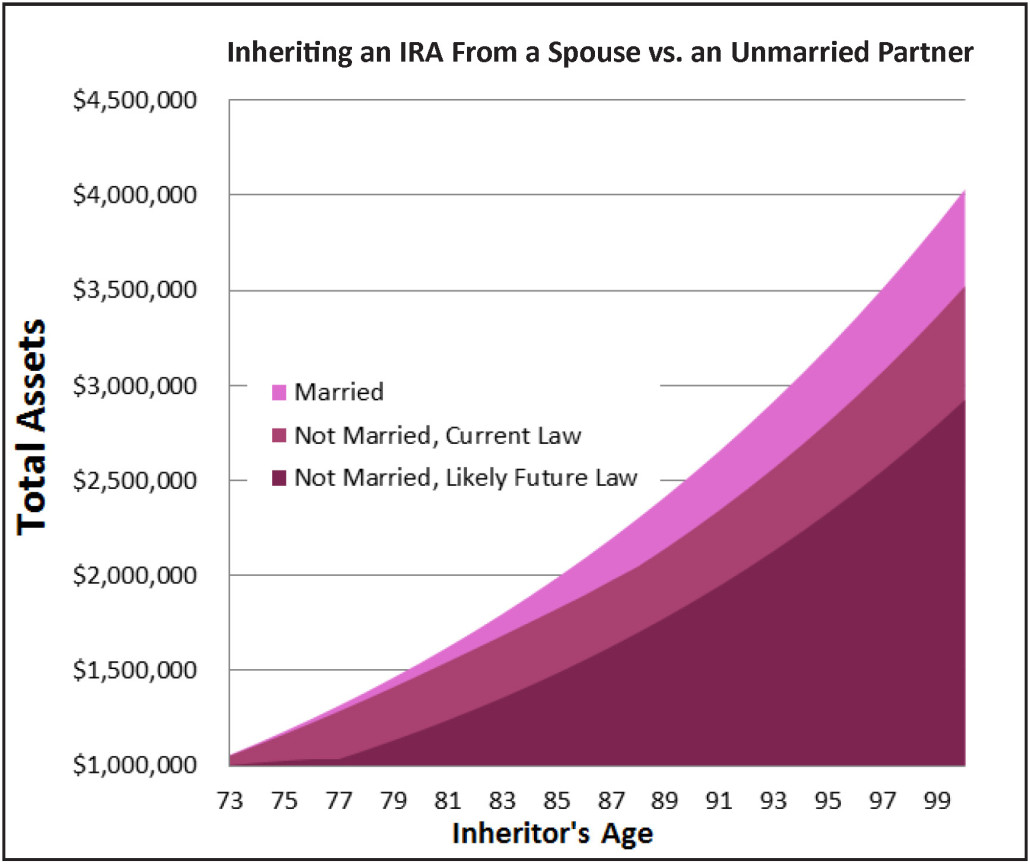

For most people, it is better to spend your non-retirement accounts before your retirement accounts. The graph that follows is from my book, Retire Secure! It shows that, the longer you can leave your money in a tax-deferred (or tax-free) account, the longer it will last.

Once your investment account is liquidated, the question becomes complicated. You should spend your traditional and Roth IRAs strategically, depending on your own personal tax situation. What the heck does that mean? I wish there was a one-size-fits-all answer, but there isn’t. However, Chapter 4 of my book, Retire Secure!, does contain an extensive analysis of this topic, and includes specific examples that may provide you with some additional insight. If you’d like to learn more about why it’s so important to spend the right money first, you can get a copy of the book from this website.

If you don’t want to read the book, here are some general points to consider. You’ll be required to take withdrawals from your traditional IRA when you turn 70 ½, and those withdrawals will be taxable. Income generated from non-qualified investment accounts is taxable. If you have enough taxable income from other sources, a portion of your Social Security will also be taxable. Most retirees don’t plan for unavoidable changes in their tax situations, and their failure to do so can be very expensive. What we strive to do in our practice is find the spending and tax management strategies that make your money last as long as possible. Ultimately, the solution is different for each client.

Readers, thank you for the questions and please keep them coming! I love hearing from you! And check back soon to read about some more real-life challenges that people like you are dealing with!