The Essence of Retire Secure For Same-Sex Couples – Part 3

This 9 part blog post series discusses along with graphs the essence of my book Retire Secure! For Same-Sex Couples: Live Gay, Retire Rich.

Retire Secure! for Same Sex Couples: Live Gay, Retire Rich quantitatively compares various courses of action. For those who don’t want to read through the explanation and detail, just looking at the 9 graphs could provide critical information with a minimum of reading effort. Please be aware that the recommendations beneath each figure will be advantageous in most situations, but not for everyone.

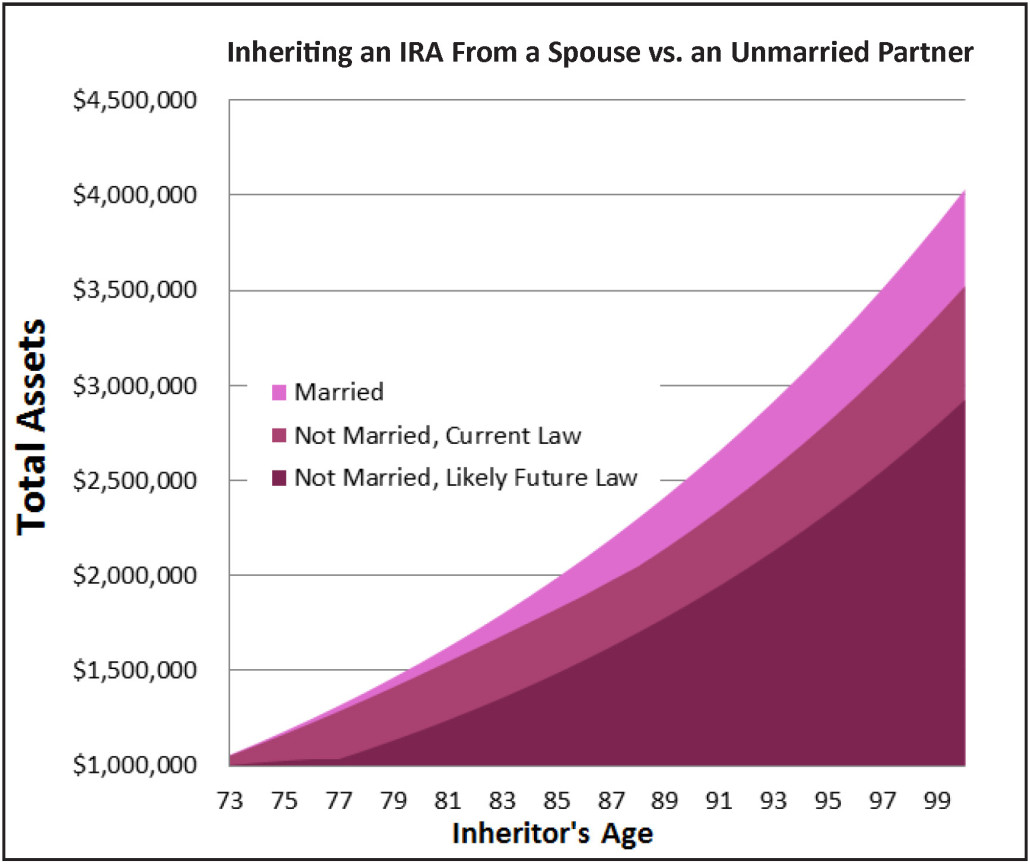

Inheriting an IRA From a Spouse vs. an Unmarried Partner

Estate planning: Get married to provide maximum IRA and retirement plan assets for your partner after your death.

This graph shows the total assets for two individuals who each inherit a $1,000,000 IRA at the age of 72—one inherits from his spouse and the other from his unmarried partner. The tax laws will allow a surviving spouse to keep the money growing tax-deferred much longer than they allow for a surviving partner. Under the projected law changes for Inherited IRAs, the scenario is even worse for the unmarried survivor. Getting married allows your surviving spouse to pay taxes later than if you stayed unmarried. Don’t Pay Taxes Now, Pay Taxes Later—even after you die.