At Last! Legal Gay Marriage States are Nationwide

“Today, we can say in no uncertain terms that we have made our union a little more perfect.” – President Obama from the White House, June 26, 2015.

“Today, we can say in no uncertain terms that we have made our union a little more perfect.” – President Obama from the White House, June 26, 2015.

In a historic 5-4 vote today, The Supreme Court of the United States (SCOTUS) issued a ruling making gay marriage states legal nationwide. The day does not appear to be happenstance, either. On June 26, 2003 SCOTUS struck down the sodomy laws, in June 26, 2013 SCOTUS struck down DOMA (the Defense of Marriage Act), and today Justice Kennedy joined by Justices Ginsberg, Breyer, Sotomayor, and Kagan delivered a beautifully human, and well thought out opinion for the majority ending states abilities to ban gay marriage.

Here is an excerpt from that groundbreaking opinion:

“No union is more profound than marriage, for it embodies the highest ideals of love, fidelity, devotion, sacrifice, and family. In forming a marital union, two people become something greater than once they were. As some of the petitioners in these cases demonstrate, marriage embodies a love that may endure even past death. It would misunderstand these men and women to say they disrespect the idea of marriage. Their pleas is that they do respect it, respect it so deeply that they seek to find its fulfillment for themselves. Their hope is not to be condemned to live in loneliness, excluded from one of civilization’s oldest institutions. They ask for equal dignity in the eyes of the law. The constitution grants them that right.”

It is so ordered.

While this is a huge coup for human and civil rights, many people do not realize the huge potential for LGBT couples to now gain the financial equality they have long been denied.

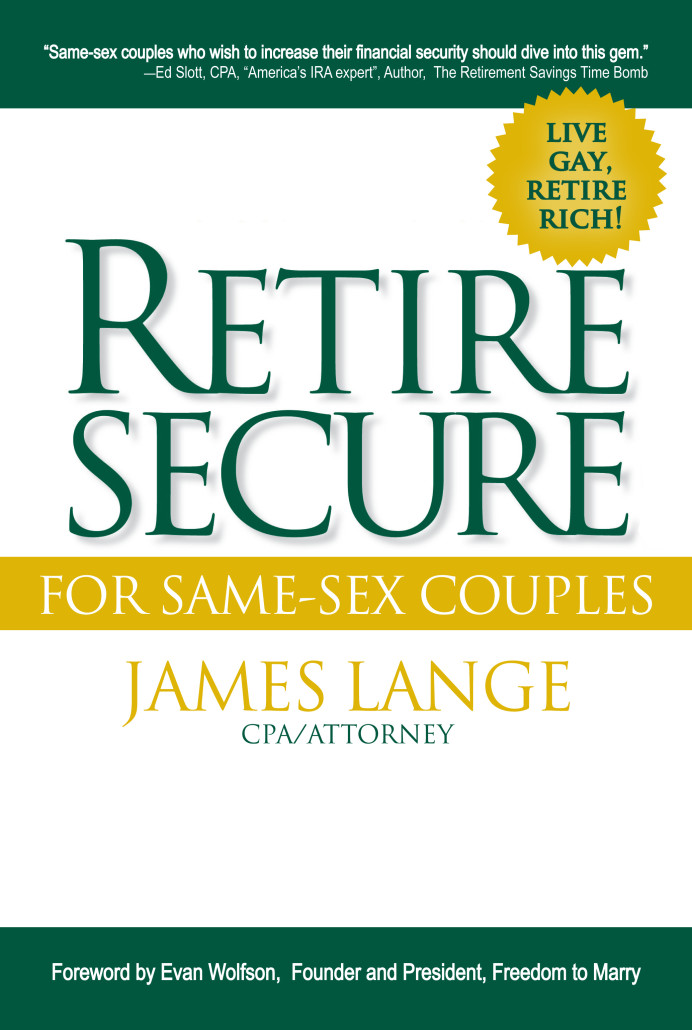

Our very own Jim Lange, has been talking about this potential financial equality for years, and advising his LGBT clients to take advantage of the opportunities that become available to them when marriage is a possibility.

His newest book on the subject, Live Gay, Retire Rich! is available for pre-order now at Amazon.com – http://amzn.to/1LAIbAY.