Celebrate New Legal Rulings with a Free Same-Sex eBook!

LGBT Ally James Lange, an author and CPA/Attorney, Celebrates New Legal Rulings by Offering a Free E-Book for Same-Sex Couples Across the Nation.

Retire Secure! for Same-Sex Couples: Live Gay, Retire Rich is endorsed by the top IRA, Social Security, and legal experts in the country and available as a FREE download for a limited time at www.samesex-equalrights.com

PITTSBURGH, October 13, 2014 – Last week was a historic week of victories for same-sex couples across the nation as 8 more states, West Virginia, Alaska, Utah, Virginia, Oklahoma, Wisconsin, North Carolina, and Indiana won the right to marry. The courts struck down the bans to marry in these states, expanding the rights for same-sex couples to marry in over half of the country. Within hours, county clerks in those states were issuing marriage licenses to couples who had been waiting for a decision to come down. Additionally, 4 more states in the 10th circuit and 4th circuit are on the verge of marriage equality as well. Colorado, Kansas, South Carolina, and Wyoming have cases pending verdicts and are expected to overturn their marriage bans in the near future. To celebrate these rulings attorney and CPA, James Lange is offering Retire Secure! for Same-Sex Couples: Live Gay, Retire Rich for free for a limited time on his web site, www.samesex-equalrights.com.

Pittsburgh LGBT Ally James Lange of Lange Financial Group, LLC has been working to help same-sex couples understand and take advantage of the tax and Social Security laws since 2002, but his campaign was re-energized when the Windsor case was decided in 2013. The laws and regulations for estate planning, tax planning, and Social Security planning have changed so significantly for same-sex couples over the last year that Jim has dedicated a large portion of his firm’s time and funds toward writing a book on gay retirement planning. Retire Secure! for Same Sex Couples: Live Gay, Retire Rich can be downloaded for FREE by going to www.samesex-equalrights.com before October 31st.

Along with the ability to get married, Lange suggests that there are many other points couples in states with marriage rights or on the verge of those rights should consider. “Married same-sex couples who live in states that recognize same-marriages will now be able to enjoy significant Social Security marital benefits and estate planning benefits, particularly if one member of the couples has a significant IRA or retirement plan,” says Lange, author of the book, Retire Secure! for Same-Sex Couples: Live Gay, Retire Rich. Mr. Lange offers four tips for same-sex couples:

- Go Into Marriage with Your Financial Eyes Wide Open. The couples who will benefit the most financially will likely be same-sex couples in their 60s or older where at least one person of the couple has a significant IRA or retirement plan. Some other couples will actually do worse financially. Finances are an important, though not exclusive, reason to get married or stay unmarried. If you are already married, speak to a tax advisor to take advantage of all the marital benefits.

- Consider How Marriage Affects Social Security Benefits. For many couples, one result of marriage is the opportunity to collect a much higher Social Security benefit. If you qualify and it is appropriate in your situation, apply for Social Security spousal benefits. There is a fantastic technique called “apply and suspend,” which is newly available to many same-sex couples in states that have recently changed their laws and to many residents of states that already afforded marriage rights. Most Social Security recipients, however, do not understand all of the possible spousal benefits of Social Security. There are significant advantages while both spouses are alive and after the first spouse dies. Find out the enormous financial benefits for free by going to www.samesex-equalrights.com before October 31st.

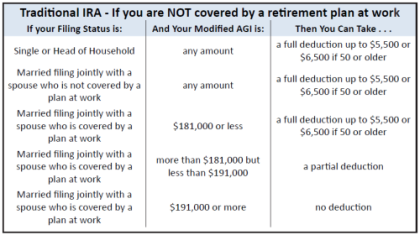

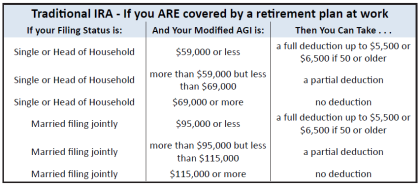

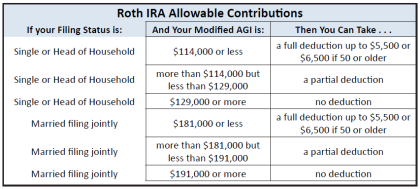

- Marriage and IRA and Retirement Planning. Regardless of your state of residence, as long as you were married in a state that recognizes same-sex marriages, you and your spouse will enjoy significant tax benefits on inheriting an IRA or a retirement plan.

- Seek Professional Advice. As with all important financial decisions, Lange suggests that couples speak with a qualified retirement and estate advisor, preferably a CPA, as well as an attorney who works with same-sex couples. “Couples need to be sure they have all the knowledge they can to prepare for their financial lives as a married couple,” says Lange. For more information about how to get a FREE copy of Retire Secure! for Same-Sex Couples: Live Gay, Retire Rich or for information on how to schedule a meeting or media interview with James Lange visit www.samesex-equalrights.comor call 412-521-2732.

About Jim Lange

James Lange, CPA/Attorney has been helping same-sex couples since 2002. He is a nationally recognized Roth IRA and retirement plan distribution expert and understands the best techniques for married couples to get the most out of Social Security. The combination of his financial expertise as well as an understanding of the changing legal status of same-sex marriage makes Jim the logical person to write and now offer for free Retire Secure! for Same-Sex Couples: Live Gay, Retire Rich which can be downloaded at www.samesex-equalrights.com before October 31st.

He’s also the best-selling author of the first and second edition of Retire Secure! with dozens of testimonials from the nation’s top IRA, investment, and estate planning experts and The Roth Revolution: Pay Taxes Once and Never Again.

Jim’s recommendations have appeared 32 times in The Wall Street Journal, 23 times in the Pittsburgh Post Gazette, The New York Times, Newsweek, Money magazine, Smart Money and Reader’s Digest. His articles have appeared in The Journal of Retirement Planning, Financial Planning, The Tax Adviser (AICPA), and other top publications. His article, Optimizing Social Security Benefits for Unmarried Couples, was just published in Trusts & Estates magazine this August.

Media Contact: Amanda Cassady-Schweinsberg, 412-521-2732

SOURCE: James Lange, CPA/Attorney