“Jim Lange provides a comprehensive road map to all the new retirement and estate planning strategies that were not previously available to same-sex couples.” — Ed Slott, America’s IRA Expert

Writing about Jim’s new book, Retire Secure! for Same-Sex Couples

The defeat of DOMA opens new doors and new avenues for same-sex couples to cut taxes and increase wealth. Take advantage of significant new opportunities in tax planning, maximizing Social Security benefits, Roth IRA Conversions, and advanced strategies for your IRAs and retirement plans, wills, trusts, and estate plans.

Our strategies offer you flexibility and smart planning that can save you and your family hundreds of thousands of dollars. New opportunities and new pitfalls abound in the shifting legal landscape of marriage equality.

Recent rulings have dramatically changed the financial, tax, and retirement and estate planning landscape for many PA same-sex couples. However, families are not taking action on strategies that can benefit PA same-sex couples. One big reason: there is a good chance you are not aware of them!

Many PA same-sex couples toy with the idea of getting married in a state that recognizes same-sex marriages—but now there are life-changing financial reasons to tie-the-knot and return to live in Pennsylvania. Getting married and combining new strategies (only available to married couples) with old concepts like maximizing Social Security benefits and calculated Roth IRA conversions can mean hundreds of thousands of dollars of additional income over the long term. Furthermore, there are new opportunities in estate planning, trusts (including total return trusts), and other strategies. Add in low-cost index funds to increase safety, increase returns and reduce investment expenses, and other innovative strategies, and you have an arsenal at your fingertips to substantially increase your wealth and financial security.

This workshop will open the doors to savvy planning for same-sex couples.

Our firm has been creating opportunities for non-traditional couples and families for over a decade, but now we have the tools to really save same-sex couples a lot of money. We can help same-sex couples construct retirement and estate plans that will put them on a par with non-gay couples who know the best strategies.

Attend one or all three of the FREE Workshops–presented by CPA and attorney James Lange – described below. You’ll discover how to control your wealth, legally reduce taxes, avoid probate, navigate the changing legal landscape, and make sure your family gets the most from what you’ve got.

Saturday, May 31, 2014

Wyndham Pittsburgh University Center

Oakland Room

100 Lytton Avenue

Pittsburgh, PA 15213

9:30 – 11:30 am

New Estate Planning Strategies for Same-Sex Couples with IRAs and Retirement Plans and Who Says You Can’t Control From the Grave? How Same-Sex Couples Can Use Trusts to Protect Themselves and Their Families

In this workshop, you will learn about:

-

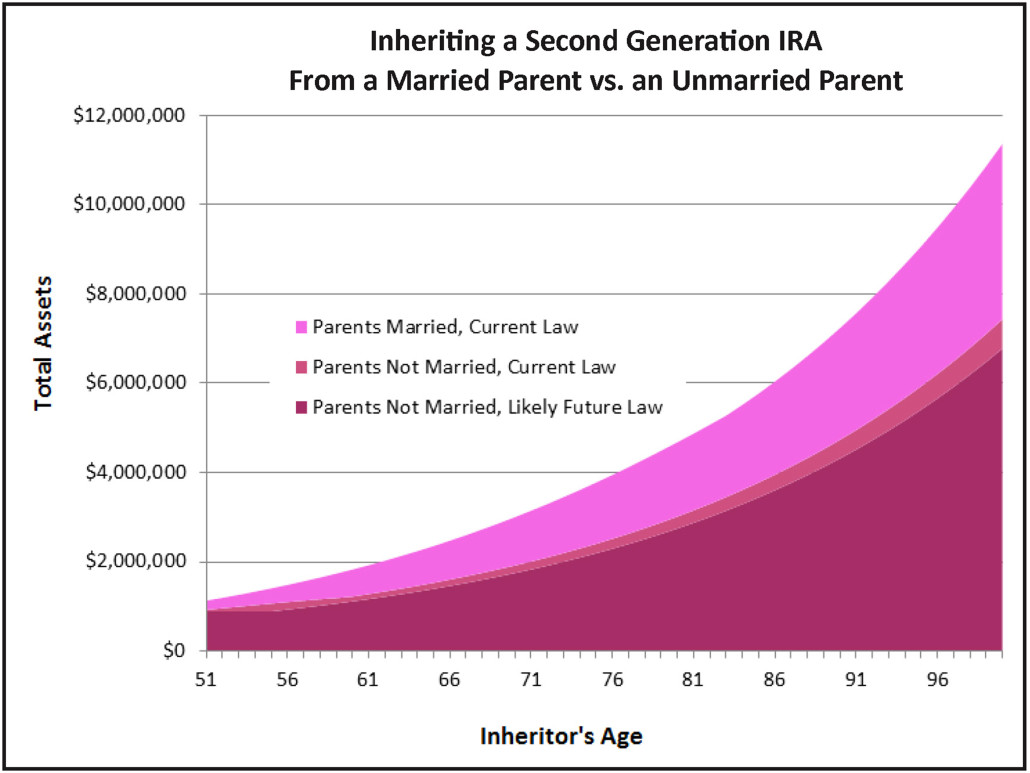

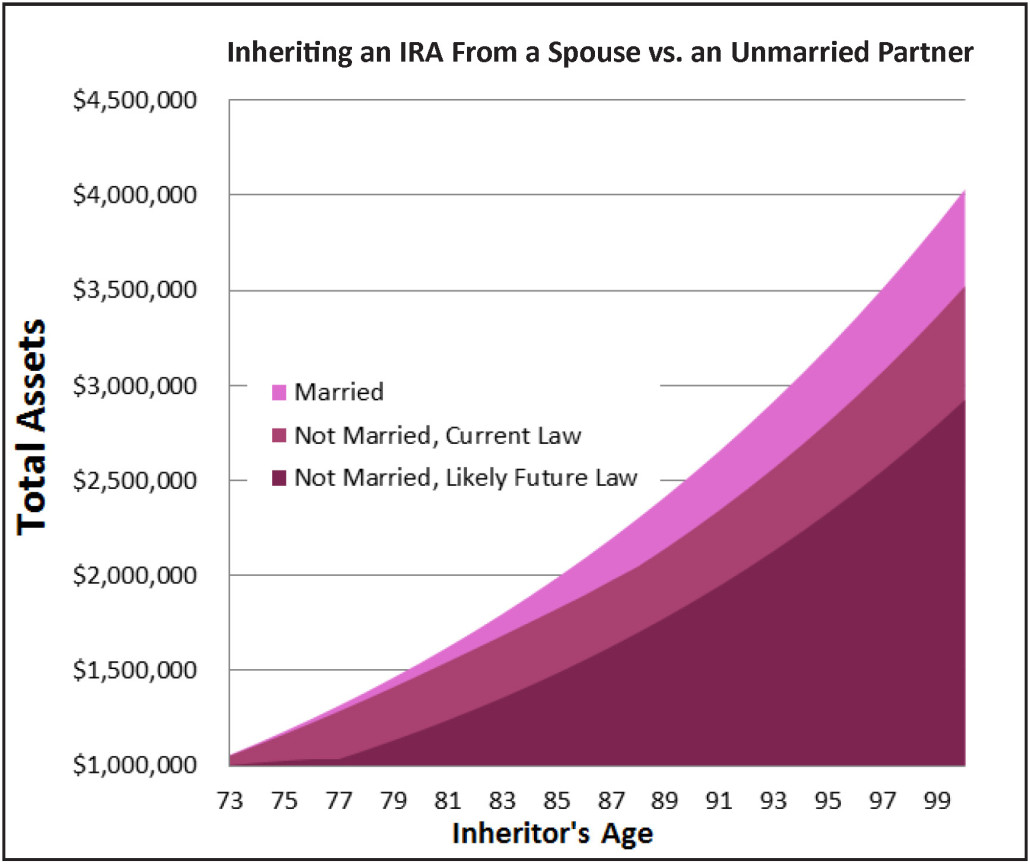

New strategies for the best way to handle IRAs and retirement plans if you are in a committed same-sex relationship.

-

The total-return trust for same-sex couples—a means to provide an income stream for your partner, but ultimately return at least some funds to your extended biological family (should you want to).

-

Alternatives to the total-return trust when your primary concern is your partner or spouse.

-

Trusts as beneficiaries of your IRA or retirement plans, whether this planning is appropriate for you, and how it can be done.

-

Avoiding probate: Should non-traditional couples plan to avoid probate?

-

Trusts for minors: “Sorry my dear, no Ferrari for you at 21!”

-

Trusts for special-needs heirs.

-

Spendthrift trusts: how to protect challenging adults from themselves and their creditors.

1:00 – 3:00 pm

The Demise of DOMA: New Financial Planning Strategies for Pennsylvania’s Same-Sex Couples

In this workshop, you’ll discover:

-

To tie the knot, or not? What benefits are available to same-sex couples legally married in other states, but living in Pennsylvania? Does it make sense to get married regardless of PA’s current laws?

-

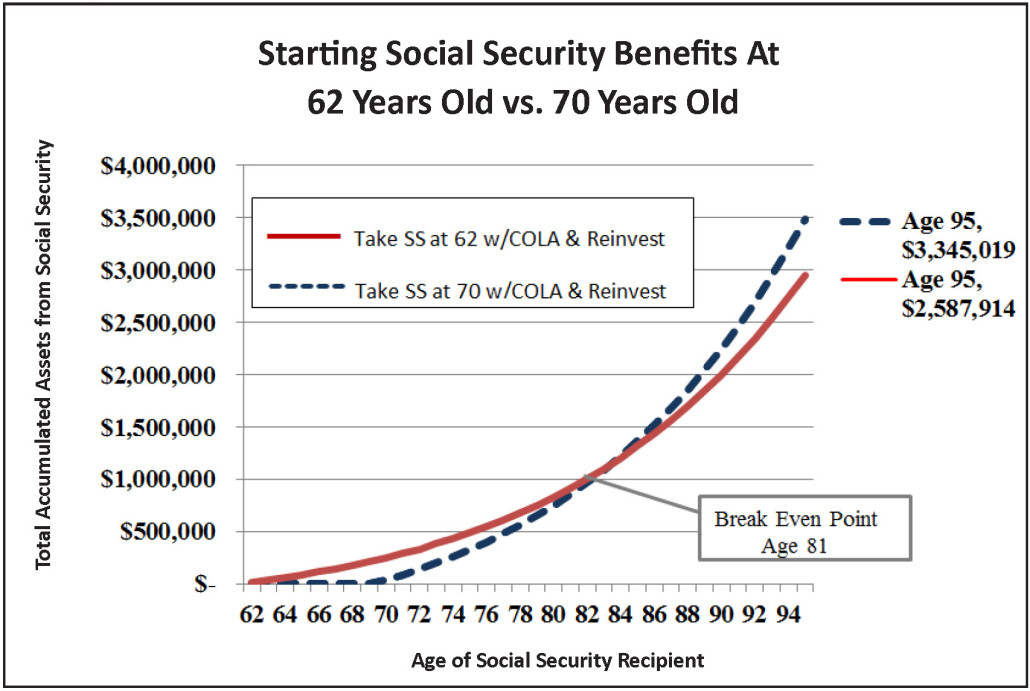

What does the DOMA ruling mean for spousal and survivor Social Security benefits? And how can non-traditional couples take advantage of these new benefits?

-

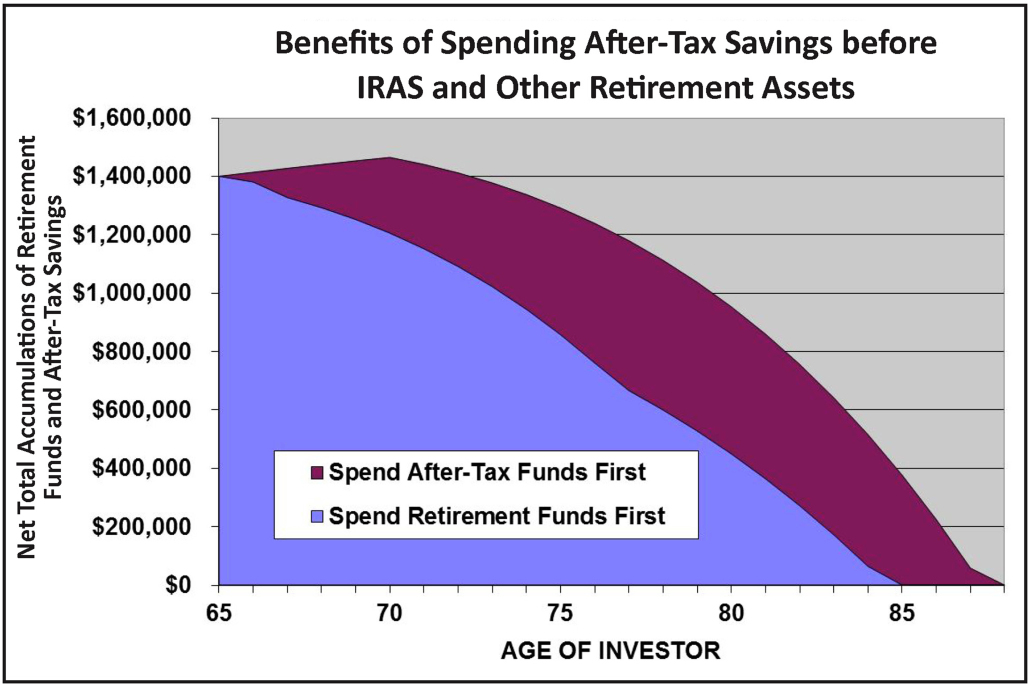

The synergy of optimizing Social Security benefits with Roth IRA conversions to increase your family’s generational wealth.

-

How to structure your wills, trusts, and retirement planning to work with today’s law, but be flexible enough to adjust to the changing legal status of same-sex marriages.

3:15 – 3:45 pm

What’s a Better Investment Strategy: Active Investing or Investing with Index Funds?

Here’s a statistic that your money manager may not want you to know: 86% of active asset managers underperform the market.* The truth is you’re likely better off with an optimized portfolio of index funds. In this special bonus workshop, we’ll cover:

-

Ideal asset allocation portfolio recommendations for your IRA and retirement plans.

-

The differences between active and passive management.

-

Whether active managers and investors statistically outperform their index benchmarks.

-

Dimensional Fund Advisors (DFA) index funds, engineered using Nobel Prize winning research.

* 2012 Index Funds Advisors, Inc. “On Personal Finance: Beating Index Funds Takes Rare Luck or Genius” by Jeff Brown.

About Your Instructor, Attorney and CPA James Lange

Attorney/CPA James Lange just finished his 4th book, Retire Secure! for Same-Sex Couples. Though not 100% official, it looks like it will become an AARP book and Evan Wolfson, founder of the Freedom to Marry campaign, will write the foreword. Jim started the first estate planning website for same-sex couples, www.outestateplanning.com, in Pittsburgh in 2002.

With 30 years of retirement and estate planning experience, Lange and his team have drafted more than 1,800 wills and trusts.

Jim is the author of two bestselling books including Retire Secure! (Wiley, 2006 and 2009) endorsed by Charles Schwab, Larry King, Ed Slott, Jane Bryant Quinn, Roger Ibbotson, Burton Malkiel, and The Roth Revolution, Pay Taxes Once and Never Again (Morgan James, 2011) endorsed by Ed Slott, Natalie Choate and Bob Keebler. He is the creator of Lange’s Cascading Beneficiary Plan™ and The Roth IRA Institute, and the recently redesigned and improved www.outestateplanning.com.

Jim’s strategies have been endorsed by The New York Times, The Wall Street Journal (30 times), Newsweek, Money Magazine, Smart Money, Reader’s Digest, Financial Planning, Bottom Line, Kiplinger’s, and many other publications. His articles have appeared in Bottom Line, Financial Planning, The Tax Adviser (the peer reviewed journal of the AICPA), the Journal of Retirement Planning, and PA Lawyer Magazine (article on the Demise of DOMA published in January/February 2014 issue).

To reserve your seat for one, or all three, of the FREE workshops, call 412-521-2732 today. Seating is limited. Refreshments will be served.

Partners are encouraged to attend.

Workshop Details

9:30-11:30 am

New Estate Planning Strategies for Same-Sex Couples with IRAs and Retirement Plans and Who Says You Can’t Control From the Grave? How Same-Sex Couples Can Use Trusts to Protect Themselves and Their Families.

The new laws allow for much more favorable treatment of IRAs and retirement plans. This workshop will start with how the new law works and what pro-active steps you can take to protect your partner/spouse and other heirs. We also delve into estate planning and the use of trusts. Of particular interest in same-sex relationships are establishing trusts when the underlying assets are IRAs and retirement plans. We will also cover Total Return Trusts, which allows flexibility in naming beneficiaries and can protect your surviving partner for his or her life. We also present the alternative to a Total Return Trust. Jim will show you the right way to plan to protect your family.

Frequently, special family circumstances make trusts appropriate for your heirs. Minors, spendthrifts, special-needs beneficiaries, and family members with drug or alcohol addiction are often great reasons to draft trusts. We will help you identify the relevant factors in deciding whether a trust is appropriate and, if it is, how to combine the benefits of a trust to get it right.

Should Same-Sex Couples Plan to Avoid Probate?

There are definite pros and cons to avoiding probate. In states like PA that do not recognize same-sex marriage, avoiding probate can save a lot of hassle. Avoiding probate minimizes delays and paperwork and is less expensive for your heirs. The main way to avoid probate is through the use of a revocable or living trust. But simply establishing a trust is not sufficient. It needs to be funded to serve its purpose.

Funding a trust often means transferring certain assets like investments and even your house into the trust. These transfers take time and money. Do the advantages outweigh the disadvantages? It isn’t a slam dunk “yes” every time. Jim Lange will explain these topics and more in this workshop specifically designed with same-sex couples in mind.

1:00-3:00 pm

The Demise of DOMA: New Financial Planning Strategies for Pennsylvania’s Same-Sex Couples

In June of 2013, the U.S. Supreme Court ruled in U.S. v. Windsor that Section 3 of the Defense of Marriage Act (DOMA) was unconstitutional and for federal estate tax purposes, a marriage cannot be narrowly defined as solely between a man and a woman. The case was later expanded to include income taxes in a revenue ruling that followed.

In this comprehensive workshop, CPA and estate planning attorney James Lange will help you navigate the shifting legal landscape that exists for same-sex couples in Pennsylvania and other states where marriage equality does not exist. Find out what opportunities now exist with the demise of DOMA and how to use them to your family’s best benefit. Same-sex couples can now benefit from the some of the same strategies that straight couples have used for years.

Jim will guide you through the complexities of flexible estate planning, optimizing spousal and survivor Social Security benefits, Roth IRA conversions, and other tax planning strategies. There are many new and advantageous strategies—all legal and offering something approaching marriage equality—with additional changes on the horizon that will be significant for you and your family.

3:15-3:45 pm

What’s a Better Investment Strategy: Active or Investing with Index Funds?

Active or index? Most people do not tackle this question until after they have amassed a large sum in their retirement accounts or other plans and are beginning to think about retiring or slowing down. However, for those who want to continue to preserve and grow their wealth, this is one of the most important questions each investor must ask. There is a clear trend away from actively managed funds and toward index investing. But if index funds are the right answer, which funds should you hold in your portfolio?

In this information-packed workshop, we present data on what we feel is the best set of index funds on the planet, Dimensional Fund Advisors. They have two Nobel Prize winners on their board of directors. Join us for this brief investment workshop to learn more about index investing and DFA and how they might benefit your family.

According to James Lange, a best-selling author, Certified Public Accountant, attorney and president of Pittsburgh-based Lange Financial Group, there are potential benefits that many people know about including the “marriage bonus” when preparing tax returns and health benefits being extended to new spouses. But what many people do not consider are 2 enormous financial benefits of marriage for couples who are 60 and over:

According to James Lange, a best-selling author, Certified Public Accountant, attorney and president of Pittsburgh-based Lange Financial Group, there are potential benefits that many people know about including the “marriage bonus” when preparing tax returns and health benefits being extended to new spouses. But what many people do not consider are 2 enormous financial benefits of marriage for couples who are 60 and over:

James Lange, CPA/Attorney started the first exclusive LGBT estate planning website in Pittsburgh, in 2002. Jim is a nationally-known Roth IRA and retirement plan distribution expert. He’s also the best-selling author of the first and second edition of Retire Secure! and Retire Secure! for Same-Sex Couples. With over 30 years of experience, Jim and his team have drafted over 1,995 wills and trusts with a focus on flexibility and meeting the unique needs of each client.

James Lange, CPA/Attorney started the first exclusive LGBT estate planning website in Pittsburgh, in 2002. Jim is a nationally-known Roth IRA and retirement plan distribution expert. He’s also the best-selling author of the first and second edition of Retire Secure! and Retire Secure! for Same-Sex Couples. With over 30 years of experience, Jim and his team have drafted over 1,995 wills and trusts with a focus on flexibility and meeting the unique needs of each client.