The Essence of Retire Secure For Same-Sex Couples – Part 1

In this 9 part blog post series I will discuss along with graphs the essence of my book Retire Secure! For Same-Sex Couples: Live Gay, Retire Rich.

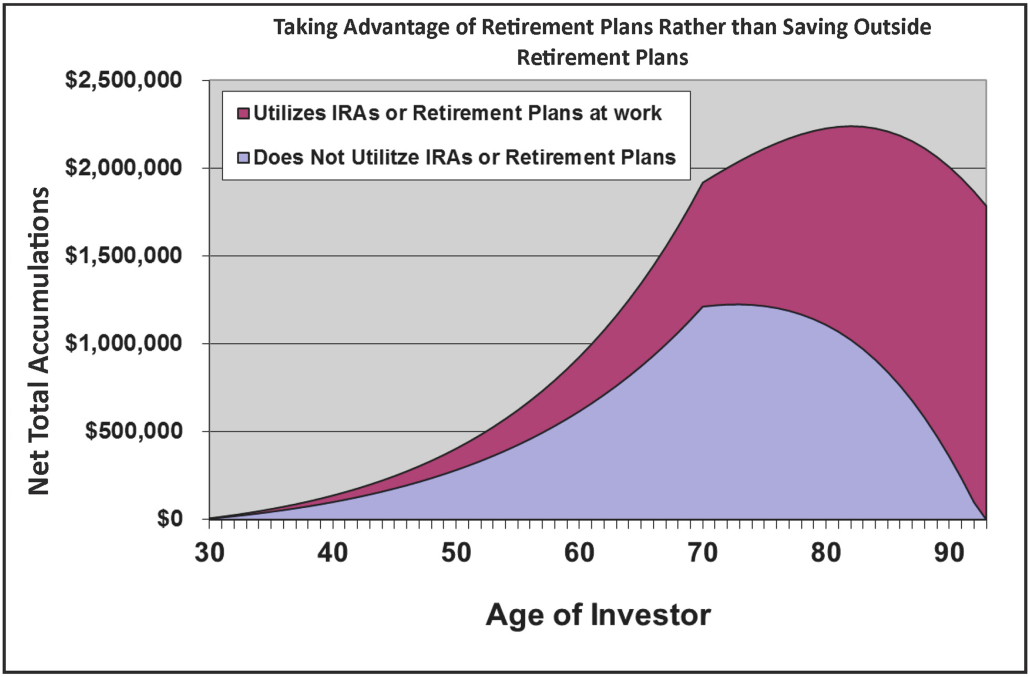

Retire Secure! for Same Sex Couples: Live Gay, Retire Rich quantitatively compares various courses of action. For those who don’t want to read through the explanation and detail, just looking at the 9 graphs could provide critical information with a minimum of reading effort. Please be aware that the recommendations beneath each figure will be advantageous in most situations, but not for everyone.

It’s better to save in IRAs and retirement plans versus saving in after-tax accounts (regular investments outside IRAs or retirement plans).

It’s better to save in IRAs and retirement plans versus saving in after-tax accounts (regular investments outside IRAs or retirement plans).

This graph shows the total net assets* for two identically situated people, except one contributes to his retirement plan at work and the other saves outside the retirement plan. They each have the same earnings, invest the same out of pocket amount at the same rate, have the same tax bracket, spend the same, etc. The difference is dramatic. The lesson: Don’t pay taxes now, pay taxes later—during the accumulation stage while you are working.

Please see page 30 in my book Retire Secure! For Same-Sex Couples: Live Gay, Retire Rich for further details.

* We measure $100 in an IRA as $75 net assets because there is a $25 income tax associated with the $100 IRA. This applies to this and the following graph.

Stay tuned next week where I’ll touch on the Benefits of Spending After-Tax Savings before IRAs and other Retirement Assets. If you are interested in seeing if you qualify for a free consultation please fill out the form on this page https://outestateplanning.com/what-we-do/ or give us a call at 412-521-2732.

– James Lange