I’m excited to inform you that my latest edition of Live Gay, Retire Rich, endorsed by the top IRA, Social Security, and legal experts in the country, is now available on Amazon. http://amzn.to/1LAIbAY

Live Gay, Retire Rich! is the Second Edition of Retire Secure! for Same-Sex Couples, now updated to include the positive holding of the Supreme Court Case Obergefell v. Hodges and its implications.

For example:

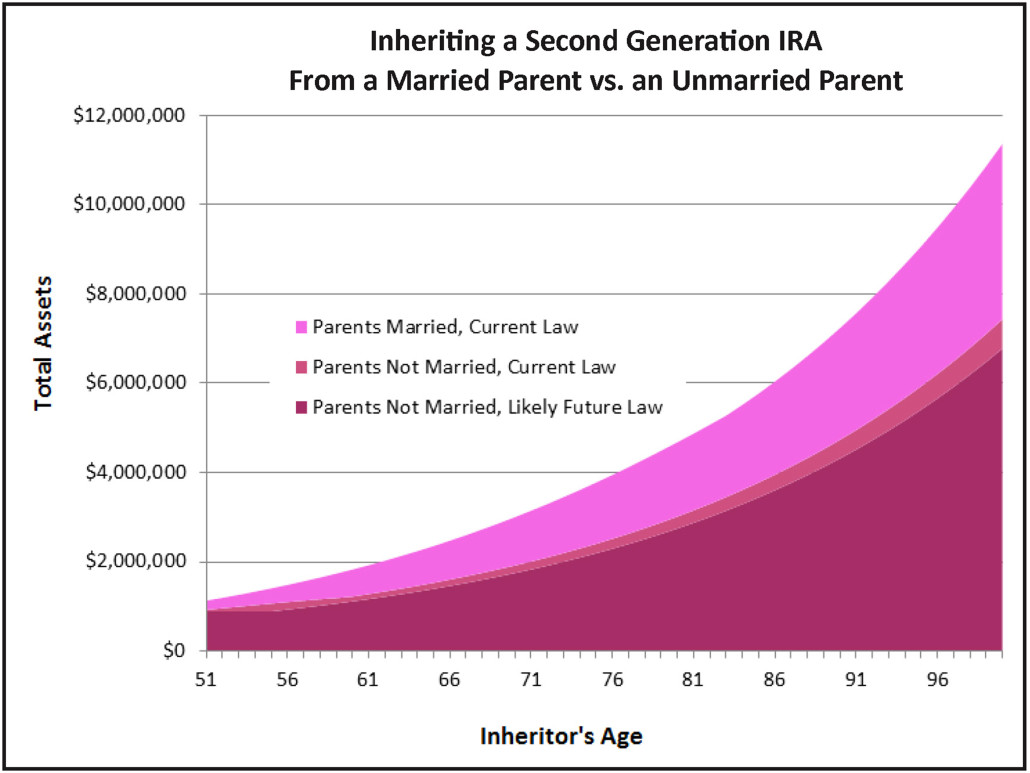

There were two gay couples with identical financial resources. They each had the same amount of money, identical investments, identical taxes, and identical earnings history for Social Security purposes. The first couple didn’t do any planning. The second couple followed the advice offered in Live Gay, Retire Rich! Using reasonable assumptions, the first couple runs out of money in 28 years while the second couple has $1.4 million and their portfolio continues to grow.

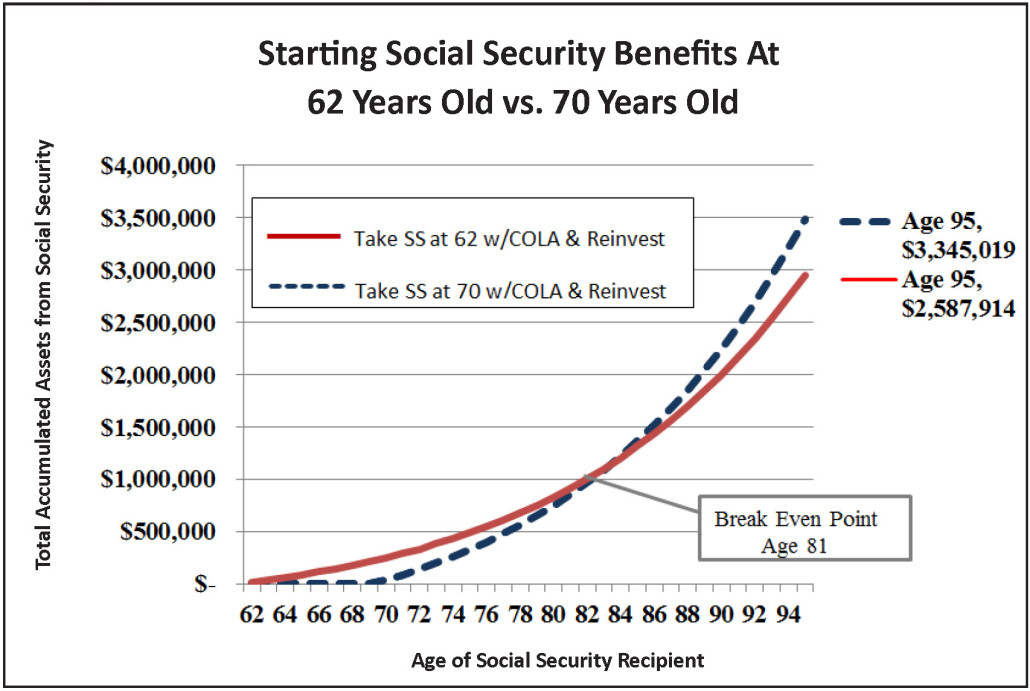

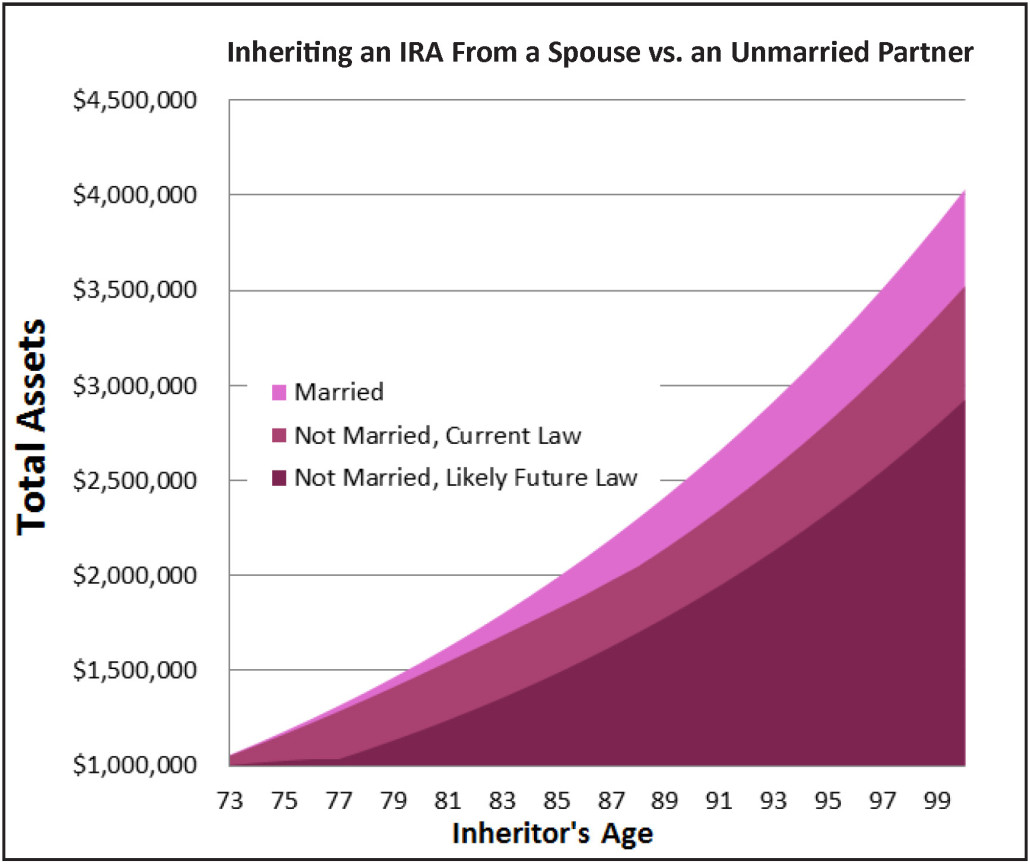

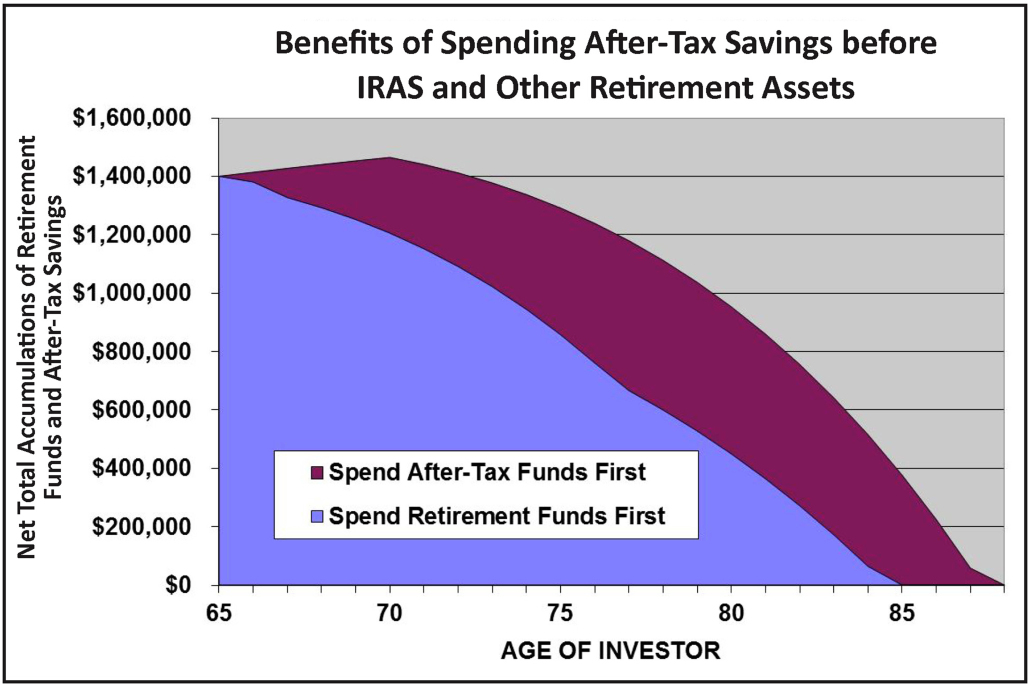

What was the difference? The first couple didn’t follow our advice; the second couple did. The first couple never got married, started receiving Social Security benefits at 62, didn’t make any Roth IRA conversions, and didn’t use key IRA and retirement plan estate planning strategies recommended in Live Gay, Retire Rich! The second couple did get married, used our recommended apply and suspend technique for Social Security, did a series of Roth IRA conversions, and used the key IRA and retirement plan estate planning strategies we recommend.

I strongly urge you to pick up my new book on Amazon. http://amzn.to/1LAIbAY.

Regards,

James Lange

CPA/Attorney

P.S. Our assumptions include a Social Security technique, apply and suspend, that may not be available for much longer. Get your copy today and find out if this strategy could work for you, before it’s too late!

____________________________________________________________________________

Praise for Live Gay, Retire Rich!:

This is an exciting time to be part of the LGBTQ community in America and it also is an important moment to take advantage of the financial opportunities that are now available to us. Jim Lange’s book Live Gay, Retire Rich! is an easy-to-understand and valuable tool that will help us navigate the financial waters and successfully plan for our future.

—Billie Jean King, Founder, Billie Jean King Leadership Initiative

Jim has generously pledged the proceeds from this book to Freedom to Marry and naturally, I appreciate that. But what I really appreciate is his bringing his expertise to bear on helping the couples for whom we have already won the freedom to marry.

—Evan Wolfson (from the foreword), Founder and President, Freedom to Marry, A national campaign dedicated to marriage equality for same-sex couples

Jim provides a comprehensive road map to all the new retirement and estate planning strategies that were not previously available to same-sex couples. But they are now, and couples who wish to take advantage of them to enhance their options, increase their wealth, cut their taxes and live with financial security should dive into this gem.

—Ed Slott, CPA, America s IRA Expert

Jim Lange has written a wonderful book for all committed couples same-sex or opposite sex who are considering marriage. Once you reach retirement age, marriage becomes the best way of preserving income and wealth for the partner who survives.

—Jane Bryant Quinn, Columnist, AARP and Editorial Director, Daily Voice Author, Making the Most of Your Money NOW

Additional testimonials from Burton Malkiel, Kaye Thomas, Jan Cullinane, Mel Lindauer, Brian Tracy, and Sidney Kess and more information about Live Gay, Retire Rich available at www.outestateplanning.com. ____________________________________________________________________________

About Jim Lange

James Lange, CPA/Attorney has been helping same-sex couples since 2002. He is a nationally recognized Roth IRA and retirement plan distribution expert and understands the best techniques for married couples to get the most out of Social Security. The combination of his financial expertise as well as an understanding of the changing legal status of same-sex marriage makes Jim the logical person to write Live Gay, Retire Rich which can now be purchased at http://amzn.to/1LAIbAY

He’s also the best-selling author of the first and second edition of Retire Secure! with dozens of testimonials from the nation’s top IRA, investment, and estate planning experts and The Roth Revolution: Pay Taxes Once and Never Again.

Jim’s recommendations have appeared 35 times in The Wall Street Journal, 23 times in the Pittsburgh Post-Gazette, The New York Times, Newsweek, Money magazine, Smart Money and Reader’s Digest. His articles have appeared in The Journal of Retirement Planning, Financial Planning, The Tax Adviser (AICPA), and other top publications. His article, Optimizing Social Security Benefits for Unmarried Couples, was just published in Trusts & Estates magazine.