The Essence of Retire Secure For Same-Sex Couples – Part 4

This 9 part blog post series discusses along with graphs the essence of my book Retire Secure! For Same-Sex Couples: Live Gay, Retire Rich.

Retire Secure! for Same Sex Couples: Live Gay, Retire Rich quantitatively compares various courses of action. For those who don’t want to read through the explanation and detail, just looking at the 9 graphs could provide critical information with a minimum of reading effort. Please be aware that the recommendations beneath each figure will be advantageous in most situations, but not for everyone.

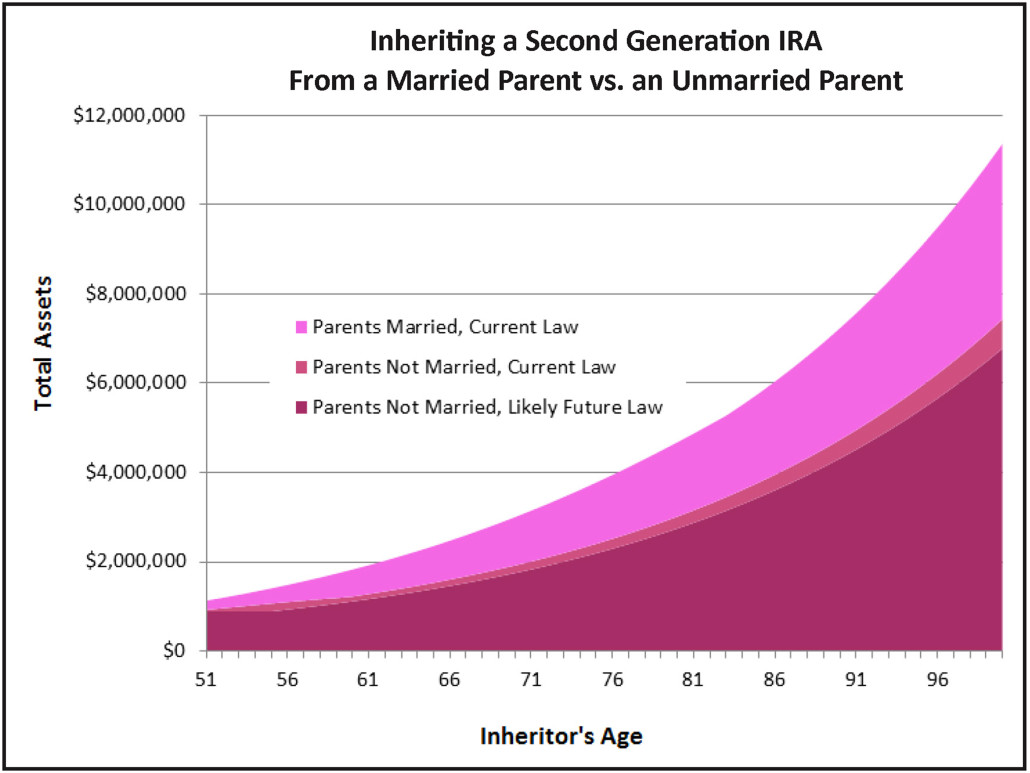

Inheriting a Second Generation IRA From a Married Parent vs. an Unmarried Parent

Estate planning: Get married to provide maximum assets for your children or other heirs after both you and your partner die.

This graph shows the difference to the eventual heir depending on whether the person leaving him the IRA had married vs. had not gotten married. Tax laws favor the married couple when one of the spouses dies, allowing the surviving spouse to “pay taxes later.” In addition to this advantage, tax laws favor heirs of a married couple. When the surviving spouse dies, his heir is permitted to “stretch” the IRA and “pay taxes (much) later.”

Tax laws penalize the unmarried couple. The first time an IRA is inherited by a non-spouse, the unmarried partner is forced to “pay taxes sooner.” The rules are even less favorable for the surviving partner’s heir, forcing him to “pay taxes (much) sooner.” Don’t Pay Taxes Now, Pay Taxes Later—even after both you and your partner/spouse are gone.